Client Profile

The Bonadio Group is a CPA firm that provides a complete range of financial and consulting services. Its Financial Institution division provides internal auditing services for banks and credit union.

Business Situation

Although The Bonadio Group’s Financial Institution Division has marketing support, it lacked the resources, processes, and technology that is required to execute and sustain a successful front-end outbound sales program throughout its 12- to 18-month sales cycle.

An effective and impactful process can be time-consuming for a company. The group’s partners sent out literature and attended banking and other networking events with some success but knew more was needed to produce consistent results. They felt they needed a more organized and structured approach, so they could spend their limited time closing sales and tending to current customers.

In addition, the division was targeting primarily New York and wanted to expand into Pennsylvania and the New England region. Although the company is well known and highly regarded in New York, it was relatively unknown in these new geographic areas. Building up and maintaining brand recognition would be an important factor in converting sales.

Exactly What They Needed

Athena’s success in other industries because of the relationship between the two companies. Although Athena SWC is a subsidiary of The Bonadio Group, this didn’t change how Athena engaged with the company; the company encountered the same processes and resources as Athena’s other clients. Athena met with the Financial Institution division and presented an overview, which included the benefits, of its unique outbound front-end sales and marketing strategy. Based on this meeting, the Financial Institution division decided Athena’s strategy was exactly what they needed to help them expand into new regions.

Getting Started

Athena and the Financial Institution division. The teams met to discuss the company’s goals and expectations and to set the foundation for the program’s success. This initial meeting is a critical step for Athena’s team to gather information about the company, its clients, and its targets as Athena would be representing the Financial Institution division during the program execution.

“We had a live meeting where we hashed through things. We are thankful we made that time investment. We also took the time to create a call script,” said Tom Giglio, Executive Vice President. “The time investment is really insignificant compared to the benefits we reaped from it.”

Going to Work

Athena worked with the Financial Institution division to clearly define the ideal clients, and then Athena’s research team went to work to identify the best potential prospects, targeting key influencers and decision makers in the geographic regions requested by the client.

Athena’s synchronized Relationship Acquisition and Management Process (RAMP) provides the capabilities and enabling technologies to execute the outbound sales and marketing strategy. These processes, which include reaching out to prospects in a consistent deliberate manner through calls, emails, and direct mail pieces; nurturing those throughout the sales cycle; and gathering market intelligence, allow the Financial Institution division to reduce their internal workload, so they could concentrate their efforts on closing sales and taking care of current customers.

Communication is another important factor for the program’s success. The Athena team keeps in close contact with the Financial institution division’s team with regularly scheduled meetings to discuss the pipeline, the status of the program, and any directional changes that might be required.

The Results

Generating Success

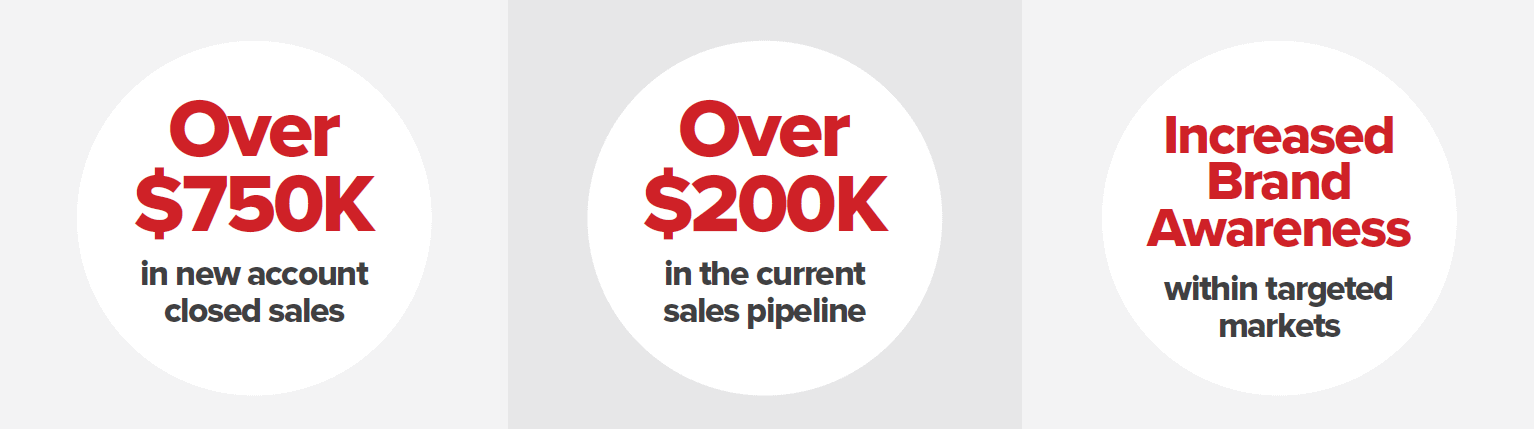

Athena has been working with the Financial Institution Division for a few years. Since that time, they have closed over $750,000 in sales and Athena continues to bring the company new opportunities. In addition, Athena’s processes have been successful with brand exposure in the new geographical areas.